Country Explorer: Finding Global Opportunities

Learn how to use our Country Explorer tool to identify international investment opportunities and expand your portfolio globally.

Country Explorer: Finding Global Investment Opportunities

Expand your investment horizons beyond local markets. Our Country Explorer tool provides comprehensive data on global STR markets, helping you identify lucrative international opportunities and build a geographically diversified portfolio.

What You'll Learn in This Guide

- How to navigate and leverage the Country Explorer to identify promising markets

- Methods for comparing markets across different regions and countries

- Techniques for evaluating international regulatory environments

- Strategies for building a diversified global portfolio

- Best practices for managing properties across multiple markets

The Power of Geographic Diversification

While many investors focus on a single market, geographic diversification offers powerful benefits that can reduce risk and enhance returns. STRProfitMap's Country Explorer makes this sophisticated investment approach accessible to everyday investors.

Key Benefits of Multi-Market Investing

- Seasonal Balance: Properties in different climate zones can provide year-round cash flow

- Economic Risk Mitigation: Protection against localized economic downturns

- Regulatory Diversification: Reduces impact of adverse regulatory changes in any single market

- Currency Hedging: Multiple currency exposure can protect against domestic currency weakness

- Emerging Market Growth: Access to markets with potentially higher growth trajectories

Real Investor Case Study

"After success with my properties in Colorado, I wanted to expand but was concerned about concentration risk. Using STRProfitMap's Country Explorer, I identified an emerging destination in Portugal with similar guest demographics but opposite peak seasons. I purchased a villa there in 2022 for €280,000 – 40% less than a comparable Colorado property. Not only has this provided consistent year-round cash flow (Colorado peaks in winter, Portugal in summer), but the property has appreciated 23% in just 18 months while delivering 14% cash-on-cash returns. The Country Explorer data gave me the confidence to invest internationally when I never would have considered it otherwise."

- Rachel M., Global Portfolio Investor

Navigating the Country Explorer Interface

1. Global Market Overview

Start with the big picture to identify regions of interest:

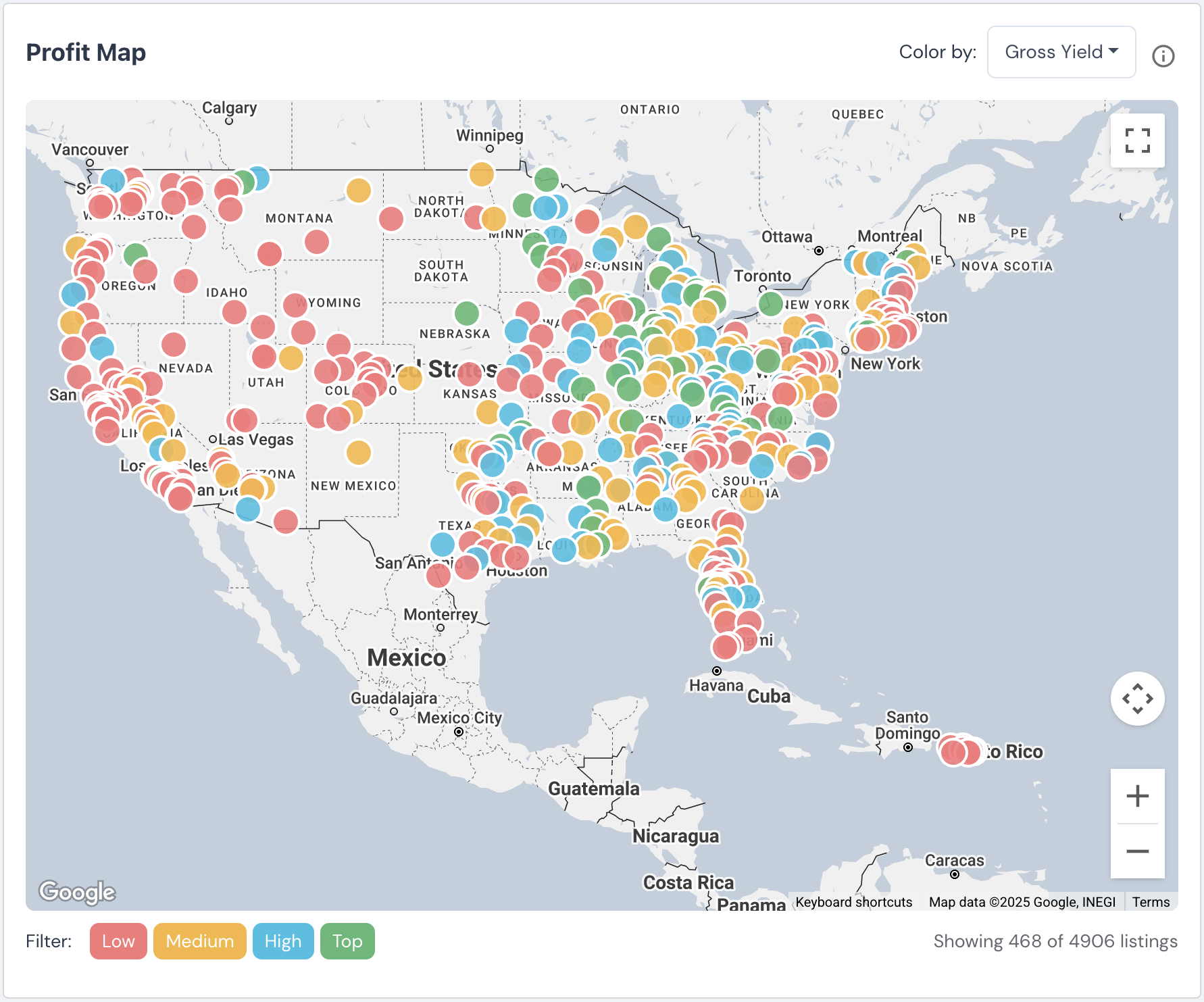

- Heat Map View: Visualize global performance metrics with color-coded overlays

- Region Comparison: Compare key metrics across major global regions

- Growth Indicators: Identify markets showing positive momentum in guest demand

- Saturation Analysis: Evaluate market maturity and competition levels

- Regulatory Overview: Quick assessment of regulatory friendliness by region

2. Country-Level Insights

Dive deeper into specific countries with detailed metrics:

- Performance Metrics: Average occupancy, ADR, and RevPAR by region and property type

- Seasonality Patterns: Monthly performance variations to identify peak and low seasons

- Market Trends: Year-over-year growth in key indicators

- Top Destinations: Highest-performing cities and regions within each country

- Guest Origin Data: Where guests are traveling from to each market

3. Custom Comparison Tools

Create side-by-side analyses of potential investment locations:

- Multi-Market Comparison: Evaluate up to 5 markets simultaneously across key metrics

- Property Type Performance: Compare how different property types perform in each market

- Investment Metrics: Analyze cap rates, cash-on-cash returns, and appreciation potential

- Regulatory Risk Scores: Assessment of regulatory stability and property rights protections

- Operating Cost Comparison: Typical expenses in each market as percentage of revenue

Evaluating International Markets

1. Market Maturity Assessment

Understanding a market's position in its development cycle is crucial for investment timing:

| Market Stage | Characteristics | Investment Strategy |

|---|---|---|

| Emerging | Low supply, growing demand, limited competition | Early entry, focus on appreciation potential |

| Growth | Rapidly increasing supply and demand, rising rates | Value-add properties, premium positioning |

| Maturing | Stabilizing supply, professional operators entering | Focus on operational excellence and differentiation |

| Saturated | High competition, pressure on rates, regulatory scrutiny | Target unique properties or avoid altogether |

| Declining | Oversupply, falling rates, high vacancy | Consider alternative uses or avoid |

2. Regulatory Environment Analysis

STRProfitMap's Country Explorer helps you navigate complex international regulations:

- Regulatory Stance Classification: From highly supportive to prohibitive

- Required Permits and Licenses: Documentation needed for legal operation

- Operational Restrictions: Limitations on minimum stays, occupancy, etc.

- Tax Implications: VAT, tourism taxes, income taxes on rental revenue

- Foreign Ownership Rules: Restrictions or special requirements for international investors

- Regulatory Trend Indicators: Whether regulations are becoming more or less restrictive

3. Economic Factors

Consider these economic factors when evaluating international markets:

- Currency Stability: Historical volatility and exchange rate trends

- Property Appreciation: Historical and projected real estate value growth

- Rental Yield Comparison: How yields compare to local fixed-income investments

- Tourism Growth: Visitor arrival trends and infrastructure development

- Political Stability: Assessment of political risk factors

- Transaction Costs: Purchase taxes, legal fees, and ongoing ownership costs

Pro Tip: The Seasonal Stacking Strategy

Use Country Explorer to implement a "Seasonal Stacking" portfolio approach:

- Identify your current properties' peak and low seasons using occupancy heat maps

- Use Country Explorer to find markets with complementary seasonal patterns

- Look for markets with similar guest demographics but opposite peak seasons

- Aim for at least 80% year-round occupancy across your entire portfolio

- Consider time zones for management efficiency (properties that can be managed during your working hours)

This approach maximizes capital efficiency by ensuring your investment dollars are consistently generating strong returns throughout the calendar year rather than sitting idle during off-seasons.

International Management Strategies

1. Property Management Options

Evaluate these management approaches for international properties:

- Full-Service Property Managers: Typically charge 20-35% of revenue, but offer complete hands-off management

- Hybrid Management: Local on-the-ground team paired with your remote oversight

- Co-Host Arrangements: Partnership with local hosts who handle in-person aspects

- Technological Solutions: Smart locks, security systems, and remote monitoring

- Management Platform Selection: Choose platforms with strong presence in your target market

2. Financial Considerations

Plan for these international financial management aspects:

- Multi-Currency Banking: Options for receiving and holding rental income in local currency

- Tax Compliance: Local and home-country tax reporting requirements

- Payment Processing: Solutions for accepting payments from international guests

- Currency Hedging Strategies: Protecting against exchange rate fluctuations

- Repatriation Considerations: Rules and costs for moving profits back to your home country

Building Your Global Portfolio Strategy

Markets with Strongest Current Potential

STRProfitMap's data highlights these regions as particularly attractive:

- Portugal's Silver Coast: Lower prices than Algarve but growing demand

- Mexico's Pacific Coast: Strong dollar advantage and developing infrastructure

- Croatia's Emerging Islands: EU membership benefits with lower prices than established areas

- Costa Rica's Central Valley: Year-round pleasant climate with growing digital nomad market

- Colombia's Coffee Region: Authentic cultural experiences with growing international interest

*These market recommendations are updated quarterly in STRProfitMap's Country Explorer.

Portfolio Construction Approach

Consider this framework for building a global portfolio:

- Core Markets (50-60%): Established markets with stable returns in your home country

- Growth Markets (20-30%): Emerging destinations with strong appreciation potential

- Seasonal Complements (20-25%): Properties specifically selected to balance seasonal patterns

- Opportunity Investments (5-10%): Early-stage markets with higher risk/reward profiles

This balanced approach provides stability while capturing growth opportunities and seasonal diversification benefits.

Action Plan: Expanding Your Investment Horizons

- Portfolio Analysis: Use STRProfitMap to analyze your current portfolio's seasonal patterns

- Complementary Market Identification: Find markets with opposite seasonality to your existing properties

- Regulatory Screening: Evaluate the regulatory environment in potential target markets

- Market Stage Assessment: Determine each potential market's position in the development cycle

- Management Plan Development: Research management options for your target international markets

- Financial Structure Setup: Establish banking and payment processing solutions for global operations

- Acquisition Strategy: Develop a phased approach to building your international portfolio

Next Steps

Now that you understand how to leverage the Country Explorer for global opportunities, explore these related guides:

Accurate — Actionable — Insightful

Find Hidden Airbnb Gems Others Miss

With STR Profit Map’s in-depth analytics, interactive profit maps, AI-powered buy boxes, and Country Explorer, uncover hidden gems, optimize guest experience, and maximize your STR profits.